Marriage and childcare support trusts

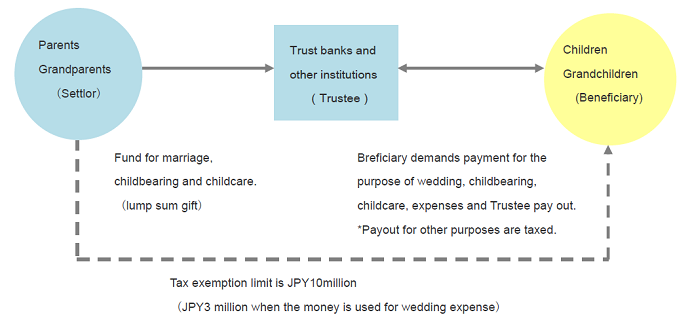

Marriage and childcare support trusts, created in the FY2014 tax reform, is the trust product for individual with a tax exemption on fund gift.

This product enables parents and grandparents to support marriage, childbearing, and childcare of their children and grandchildren through facilitating early transfer of their assets.

Beneficiary (Children and grandchildren) enjoy a gift tax exemption in a lump sum up to JPY10million. (beneficiary aged over 20 but under 50)

Marriage and childcare support trusts

Specified planned-giving trusts | Legal guardianship support trusts | Qualified educational fund giving trusts | Marriage and childcare support trusts | Employee stock ownership plan trusts | Testamentary substitute trusts/ Successive life interest trusts | Trusts With Certificates of Beneficial Interests | Security trusts | Emission credits trusts | Intellectual property rights trusts | Trust-type rights plan

Types of trusts | Money trusts & Loan trusts | Investment trusts | Family trusts·Inheritance - related operations | Real estate trusts·Real estate business | Pension trusts | Asset formation trusts | Asset securitization type trust(monetary claims trusts, real estate trusts) | Securities trusts | Securities trusts (specified money trusts, fund trusts) | Stock Transfer Agencies | Charitable trusts | Specified donor trusts | Product expectations